Predictions for the 2023 Ann Arbor Area Real Estate Market

14 things we can expect from Ann Arbor Area home prices and interest rates this year.

Market Stats as of 2/07/23:

30 Year Fixed Rate Mortgage- 6.09% (down)

15 Year Fixed Rate Mortgage- 5.14% (down)

CPI (Dec. Inflation)- 6.5% (still elevated)

Inventory of Homes for Sale- Low (same)

Recapping the 2022 Ann Arbor Area Housing Market

The housing market started out strong at the beginning of the year, but the genie was out of the bottle by Summer 2022. With interest rates skyrocketing, Ann Arbor home sales slowed through the end of the year.

In January 2022, interest rates on 30-year fixed mortgages were 3.22% on average.

By the end of October, that rate shot up to 7.08%.

In a nutshell, this explains the housing market last year.

By the end of last year, Days-On-Market started to increase in the Ann Arbor Area, but long-term interest rates had come down some.

Despite that, median prices ended higher for the year.

Interest rates will remain top of mind in 2023. Long-term interest rates are still almost double what they were a year ago (sitting at about 6.09% at the time of writing in February 2023).

Couple this with the fact that many homeowners have mortgages in the 2-to-4% range with no incentive to sell unless they must. These low interest rate mortgages are clearly an asset to those holding them. But, it sets up a stalemate situation in the market between buyers and sellers.

Buyers have to accept they are going to pay more for less house and sellers worry they won’t get the same house for the payment they have locked in at a low rate.

With all of this, what can we expect in the new year?

What is Forecasted for the Ann Arbor Area Housing Market for 2023?

There are 14 trends we see for the year.

1. The Job Market and Economy Will Continue to be Strong in the Ann Arbor Area, Driving Housing Demand

According to two University of Michigan economists that spoke on March 25, 2022 at the Washtenaw Economic Club event at Washtenaw Community College, the Ann Arbor area economy will be strong through 2024 despite inflation as written by Fran LeFort here.

Also, this chart published by the University of Michigan shows that employment in the Ann Arbor area is expected to be higher than Michigan overall through 2024.

2. Lower Mortgage Rates Compared to the Peak of Last Year

As stated earlier, 30-year mortgage rates got as high as 7.08% at the end of October last year and in December of 2022 the rate was about 6.51%.

At the time of writing, the 30-year mortgage rate is about 6.09% and is forecasted to go even lower by the end of 2023.

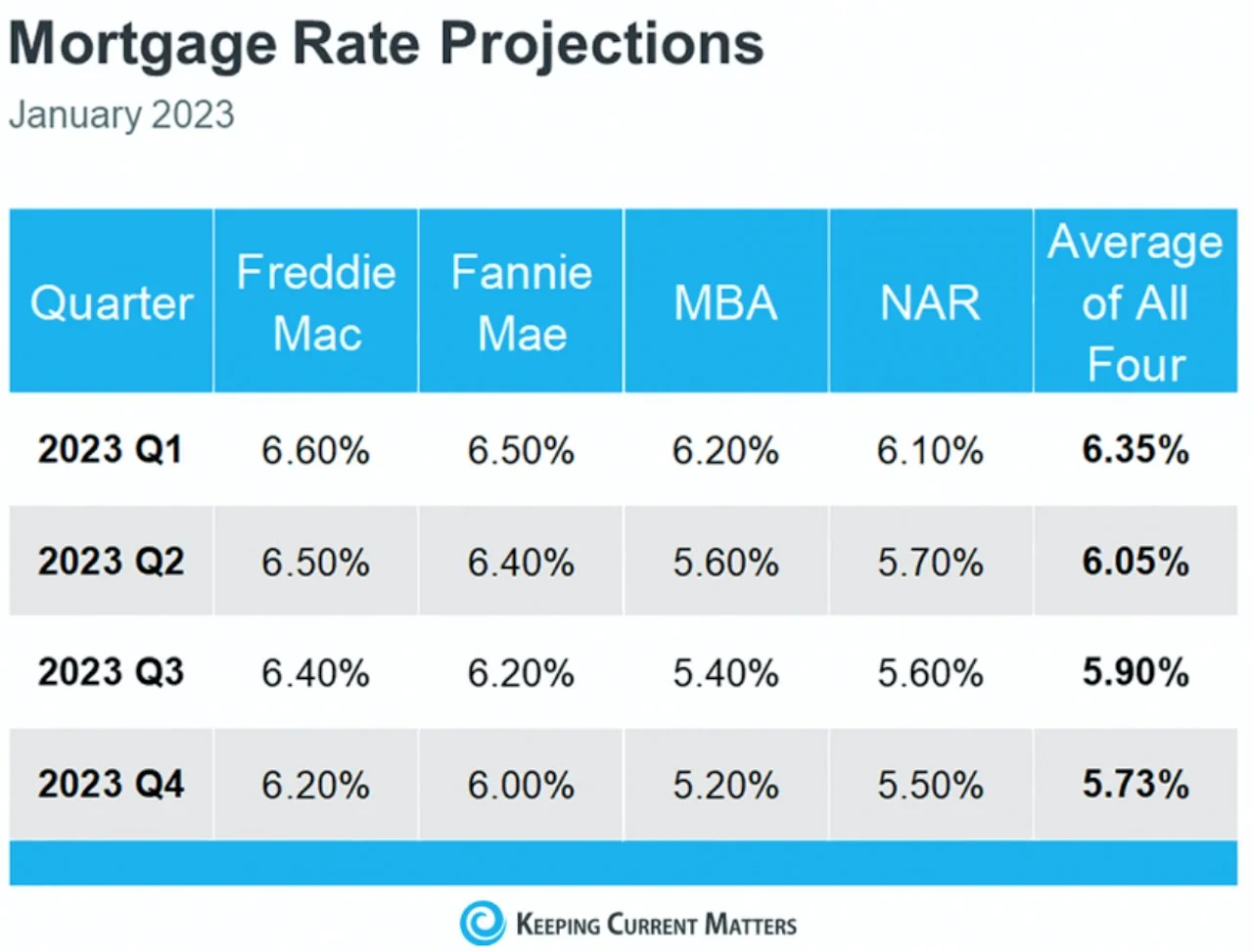

According to this chart comparing forecasts from traditional mortgage experts, the average of their projections has rates as low as 5.73% by the fourth quarter of 2023.

In addition, this chart shows that as the Federal Reserve continues to raise the federal funds rate, the rates on the 30-year mortgage continues to fall.

So, the consensus view is lower long-term rates this year compared to the peak last year.

3. Elevated Short Term Interest Rates Like Home Equity Lines of Credit and Credit Cards Compared to Last Year

Rates on short-term debt like credit cards and Home Equity Lines of Credit are directly affected by the Federal Reserve raising rates.

If you have balances on these types of loans, you can expect the rates to increase and stay elevated in 2023.

It would be wise to pay these balances down or refinance into a fixed rate loan like a Home Equity loan instead of a line of credit.

4. Low Inventory of Properties for Sale and For Rent

The inventory of homes for sale has been trending down for single family homes and condos but more dramatically for single family homes.

We forecast that the trend will continue as people with low interest rate mortgages will be reluctant to sell unless they have to.

There is also high demand for rental properties in the Ann Arbor area and just like the inventory of single-family homes and condos for sale, there is not enough inventory and new development is not making up for the shortage of available rentals.

2023 would be a good time to think about turning your basement into an apartment to rent or offering a part of your living space as a rental.

5. Median Prices Will Continue to Increase

We predict the median sales price for single family homes and townhome/condos will follow the historical trend line up in 2023.

Median prices will be supported by low inventory of houses for sale and demand for housing as long-term interest rates come down from recent highs.

6. Rents Will Continue to Increase

Rents will continue to increase in 2023 but at a slower pace.

As long as the local economy and employment stays strong and enrollment trends at the University of Michigan continue to be healthy, there will continue to be a demand for rental units.

7. It Will Be More of a Balanced Market Between Buyers and Sellers and Less of a Seller’s Market Especially at The Higher Price Points

Sellers with low mortgage rates will be reluctant to sell and buyers will be reluctant to pay more than they need to with mortgage rates being double what they were a year ago.

According to Redfin, the Ann Arbor housing market is somewhat competitive with a score of 50/100.

We expect the market to continue to be more balanced this year between buyers and sellers and less of a seller’s market like it was the first half 2022.

“Median prices will be supported by low inventory of houses for sale and demand for housing as long-term interest rates come down from recent highs.”

8. Days on Market Will Increase Compared to Last Year, Especially for The Higher Price Points

In December of 2022, we could see the days on market ticking up and we expect that number to be higher in 2023 than it was on average last year.

As you can see in the chart of historical days on market, the numbers were ticking up at the end of 2022.

This is also another indication of the market becoming more balanced between buyers and sellers.

9. There Will Be More Development of Single and Multifamily Projects, But Not Enough to Offset the Lower Inventory of Available Properties to Buy or Rent

There have been several articles written recently like this one in MLive about the number of new real estate developments in 2023 in Ann Arbor and Washtenaw County.

The new developments will help but there will still be a lack of inventory and they take time to build before their effect can be seen.

10. Housing Affordability Will Continue to be Challenging For Homeowners and Renters, Although Ann Arbor is Relatively Affordable Compared to Other Hot Locations in the Country

There is no doubt that housing affordability for homeowners and renters has been a growing problem in the Ann Arbor area.

This chart shows how low affordability has gotten—especially in the last year.

This is another pressure on rent growth and median home price growth as people’s wages simply have not kept pace with the increasing cost of housing.

11. Worker Shortages in the Area Will Continue Due to Housing Being Unaffordable for Many in the Ann Arbor Area

It is tough to take a service industry job or moderately paying job that the community of the Ann Arbor area needs people to fill when workers also must provide housing for themselves and their family.

This article explains the situation very well and the need for more affordable, workforce housing options in the area.

This will continue to be an issue in 2023.

11. Climate will Continue to be in the News and the Ann Arbor Area and Michigan in General will Benefit from Policies like Ann Arbor’s A2Zero Carbon Neutral Strategies and Similar Programs and Michigan’s Temperate Climate.

As more and more climate related news stories happen in 2023, people around the country will be looking for places to live or retire that have temperate climates and progressive climate policies.

Even the website Redfin offers a Climate Risk section now on their website for locations around the country.

This is their data for Washtenaw County.

Recent articles like this one in Wired magazine have been written about how Michigan and the Great Lakes region may be a climate haven in the country.

The city of Ann Arbor also has their A2Zero program which aims to have a carbon neutral community through policy decisions as well as similar local organizations and others initiatives in surrounding communities in Washtenaw County.

This will get the Ann Arbor area more and more favorable attention in 2023 and put more demand on housing.

12. The Growing Number of Retirees in the Country Living in Higher Cost of Living Locations will be Looking for Affordable Places to Move with a Temperate Climate and Abundant Natural Resources.

In fact, with articles like this one in US News & World Report from November 2022 that ranks Ann Arbor the 8th best place to retire in the country, more and more retirees will be looking to move to Ann Arbor in 2023.

Related, this chart from Redfin shows the areas around the country that people are moving from to Ann Arbor.

The housing costs in many of these places make the relatively unaffordable housing costs in the Ann Arbor area look affordable.

This trend will continue in 2023.

13. Ann Arbor and Other Parts of Michigan Will Continue Benefiting From Remote Work.

According to Ann Arbor Spark’s website and Teamwork.com, Ann Arbor was the #3 best city for remote workers in the country.

There were many other national recognitions listed for the Ann Arbor area on their website for being a great place to live and work in the country.

This trend will continue in 2023 and put more demand on housing.

14. Unfortunately, There Will Be an Increase in Homelessness Which Affects Everyone

This article from MLive from February 1st 2023 (just a few days ago), talks about how the skyrocketing cost of housing is pushing more and more people into homelessness.

This is an issue that affects everyone.

Unfortunately, this trend will continue in 2023.

Bottom Line for the Ann Arbor Area Housing Market for 2023

Buyers and sellers will find the housing market to be more balanced in 2023.

Although buyers will find the market friendlier than in early 2022, sellers will still enjoy rising home values and sale prices. Declining affordability will challenge or preclude many families from the market.

We expect inventory of homes to remain low.

Mortgage rates will continue to fall in 2023.

Days on market will be higher than last year.

However, median sales price will continue to increase this year.

To your success!

Arbor Advising has a passion for helping people buy, sell and invest in real estate. We believe real estate is the best way to create passive income, grow your wealth and provide inflation adjusted returns in retirement with fantastic tax benefits.

Want to learn more? Contact us.

Disclaimer:

Always speak to your CPA, investment advisor and attorney before making any investment decisions. Past performance does not guarantee future returns. Arbor Advising seeks to educate and does not endorse any specific product, service or investment.