December 2022 Ann Arbor Area Housing Market Update

How did the real estate market in the Ann Arbor Area look last month, and what does it signal going forward?

Editor’s Note- MLS market data is available two weeks after the close of the reported month from the Ann Arbor Board of Realtors for the Ann Arbor Area.

Market Stats as of 1/25/23:

30 Year Fixed Rate Mortgage- 6.15% (down)

15 Year Fixed Rate Mortgage- 5.28% (down)

CPI (Dec. Inflation)- 6.5% (still elevated)

Inventory of Homes for Sale- Low (same)

What The National Media is Telling Us

The media is telling us many things about the economy and the housing market.

1. The economy is heading into a recession in 2023 if it is not already in one.

2. Layoffs will increase in 2023.

3. Interest rates are going to go higher.

4. Inflation will still be elevated.

5. Wages are not keeping up with inflation.

6. Housing is becoming increasingly unaffordable.

7. There will be a housing market correction in 2023.

8. Prices of real estate in general will fall.

With all this bad news, you would think the real estate market in the Ann Arbor area would be showing signs of stress.

What is the Reality for the Ann Arbor Area Real Estate Market as of December 2022?

Let’s look at six housing market indicators across the entire MLS for the largest possible data sample using data from the Ann Arbor Board of Realtors.

1. Inventory of Homes and Condos for Sale-

(Low Supply)

We can see there were fewer homes and condos for sale in December 2022 compared to recent years. Having fewer properties for sale will continue to put upward pressure on prices.

2. New Listings-

(Low New Supply)

There was a similar story with fewer new properties coming on the market contributing to a greater lack of inventory and further upward pressure on prices.

3. Days on Market-

(Higher in Dec, Less Overall For the Year)

The days on market is a mixed picture. We can see an increase in the number of days on market in December 2022 for both single family homes and condos. However, looking at the year-to-date data for both, there is a clear trend to less days on market last year compared to recent years. We will have to watch this trend in 2023.

“Ann Arbor is not the national housing market. ”

4. Median Sales Price-

(Higher)

Clearly, the median sales price for both single family homes and condos increased both in the month of December 2022 and year-to-date in 2022.

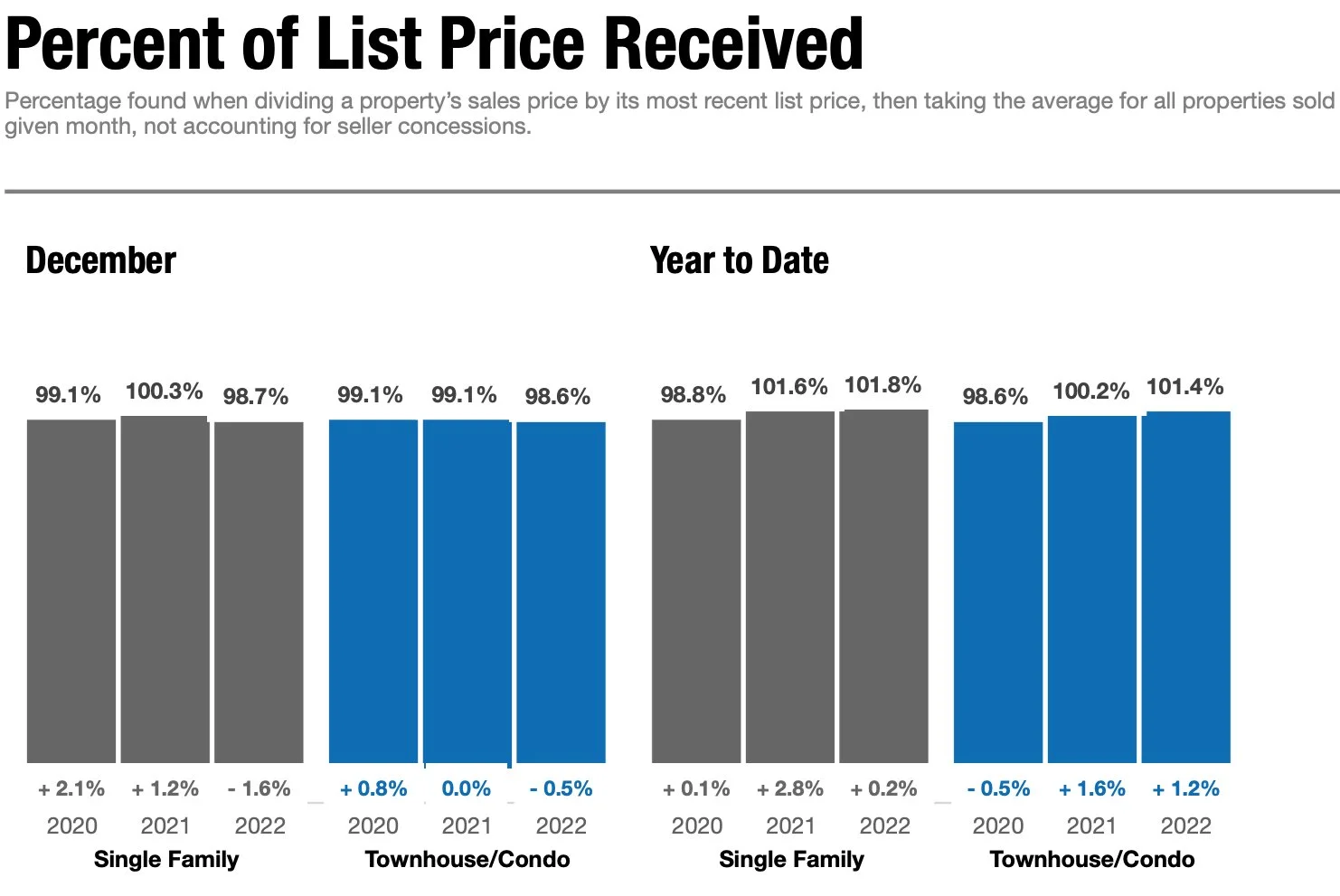

5. Percent of List Price Received With Offer-

(Basically 100%)

Although we can see a slight dip in price received compared to list price in December 2022 for both single family homes and condos, the price received is still very close to 100% and year-to-date it is over 100% for 2022. This will be another interesting data point to watch in 2023.

6. Housing Affordability Index-

(Housing is Affordability is Decreasing)

Unfortunately, this is one area the housing market could use some improvement. December 2022 saw the Affordability Index drop significantly greater than in recent years and the story is similar for 2022 as a whole. Ann Arbor area real estate is unfortunately getting less affordable for more and more people.

So, after looking at all six housing market indicators, does the housing market in the Ann Arbor area reflect what the media is telling us?

Bottom Line for the Ann Arbor Housing Market for December 2022

Ann Arbor is not the national housing market.

It’s doing better than what the national media is telling us about the housing market.

We can see in the data that days on market have increased for both single family homes and condos in December but down overall for the year.

Additionally, the price received compared to list price dipped slightly for both as well in December but basically 100% of list price.

However, the median sales price is still higher for both and the number of properties for sale continues to decrease helping support prices.

Housing affordability is legitimately a challenge in the Ann Arbor area and seemed to get worse in December and in 2022 overall.

Heading into 2023, we will have to keep an eye on inventory levels, days on market and price received compared to list price.

To your success!

Arbor Advising has a passion for helping people buy, sell and invest in real estate. We believe real estate is the best way to create passive income, grow your wealth and provide inflation adjusted returns in retirement with fantastic tax benefits.

Want to learn more? Contact us.

Disclaimer:

Always speak to your CPA, investment advisor and attorney before making any investment decisions. Past performance does not guarantee future returns. Arbor Advising seeks to educate and does not endorse any specific product, service or investment.